Use this Free online NPV, IRR and PI Calculator to compute the net present value, internal rate of return, and profitability index (PI) at once.

Enter your parameters in the NPV, IRR and PI Calculator below:

(Multiple cash flows separated by comma): Interest Rate or MARR(%):

How to Use the NPV IRR Calculator

To use the NPV IRR calculator, simply input the following:

- Initial Investment – The upfront cost of the project

- Cash Flows – The expected future cash flows for each period, separated by commas

- Interest Rate (MARR) – The minimum acceptable rate of return for NPV calculation

The calculator will output:

- IRR – The internal rate of return

- NPV – The net present value at the input interest rate

- Profitability Index – The ratio of NPV to initial investment

What is IRR?

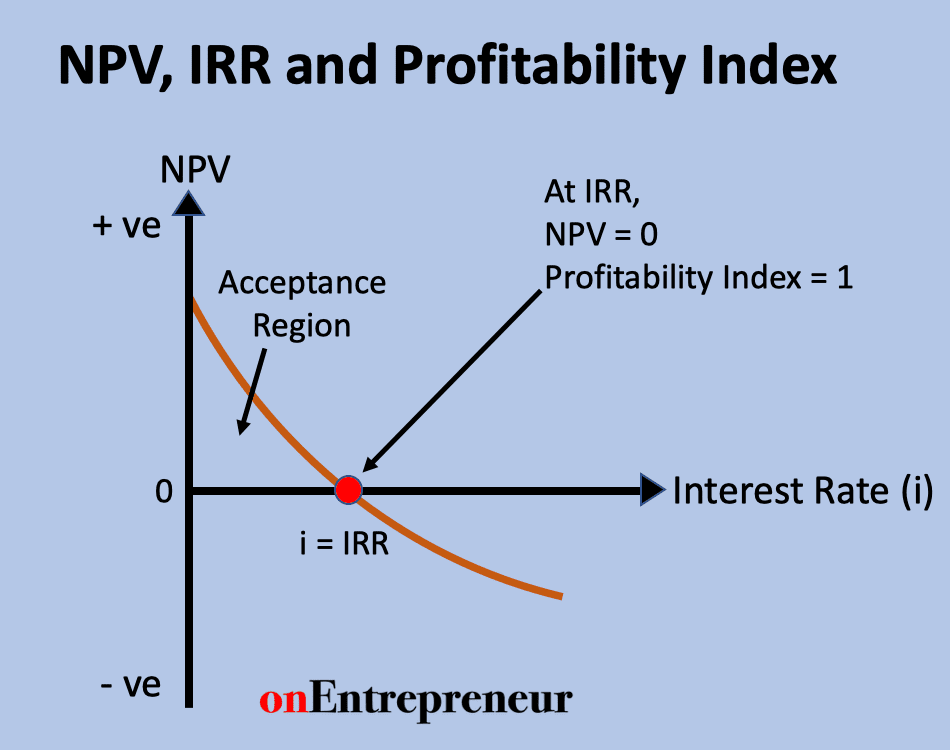

IRR stands for Internal Rate of Return. It is the discount rate that causes the net present value (NPV) of a project to equal zero. In other words, it is the expected compound annual rate of return for the project.

Formula:

Discount rate that makes NPV = 0

A higher IRR indicates a more desirable project.

Use our free IRR Calculator.

What is NPV?

NPV stands for Net Present Value. It is the current value of expected future cash flows minus the initial investment. NPV accounts for the time value of money by discounting future cash flows to present value using a discount rate.

Formula:

NPV = Present Value of Future Cash Flows – Initial Investment

A positive NPV indicates a profitable project.

Use our free NPV Calculator.

IRR vs NPV

IRR and NPV help assess the viability of a project but in different ways:

- IRR measures the expected rate of return as a percentage

- NPV measures the net profit in dollar terms after discounting cash flows

IRR doesn’t consider investment size, while NPV does. For comparing projects of different sizes, NPV is better.

Profitability Index

Profitability Index is the ratio of the project’s NPV to its initial investment.

Formula:

Profitability Index = NPV / Initial Investment

A profitability index greater than 1.0 indicates a worthwhile project.

Use our free Profitability Index Calculator.

Project Appraisal Using IRR, NPV, and Profitability Index

- IRR should exceed the minimum required rate of return

- NPV should be positive

- Profitability index should exceed 1.0

When these three conditions are met, the project is likely to be profitable.

Here is a chart summarizing the meaning and relationship between NPV, IRR and Profitability Index (PI).

Example of Decision Rule using IRR, NPV and PI

An energy efficiency project requires an initial investment of $100,000. It is expected to produce annual savings of $40,000 for each of the next 5 years. The company’s minimum required rate of return is 10%.

- IRR is 28.649%. This exceeds the minimum 10%, so satisfies the IRR rule

- NPV is $51631.47 (at 10% discount rate). It is positive, so satisfies the NPV rule

- Profitability Index is 1.52 ($51631.47 / $100,000). This exceeds 1.0, so satisfies the profitability index rule

Since all three criteria are met, this project can be accepted under NPV, IRR, and profitability index decision rules.