Please enter the parameters into the simple interest calculator below.

How to use this Simple Interest Calculator?

- Enter the value of the principal, the number of periods, and the simple interest rate.

- Press CALCULATE to calculate the value of simple interest and the total amount based on the entered principal, number of periods, and interest rate.

- Click RESET to reset the entered values and start a new calculation. (You can also start a new calculation without pressing RESET).

What is Simple Interest (SI)?

Simple interest is calculated on a loan’s principal amount or the first deposit into a savings account. Unlike compound interest, simple interest doesn’t compound, so an account holder only earns interest on the principal and a borrower never has to pay interest on the previously accumulated interest.

So, simple interest (S.I.) is a way of figuring out how much interest will accrue on a specific principal sum of money at a certain rate of interest. For instance, if someone borrows $1000 at a rate of 10 p.a. for two years, the person will pay S.I. on the borrowed money for those two years.

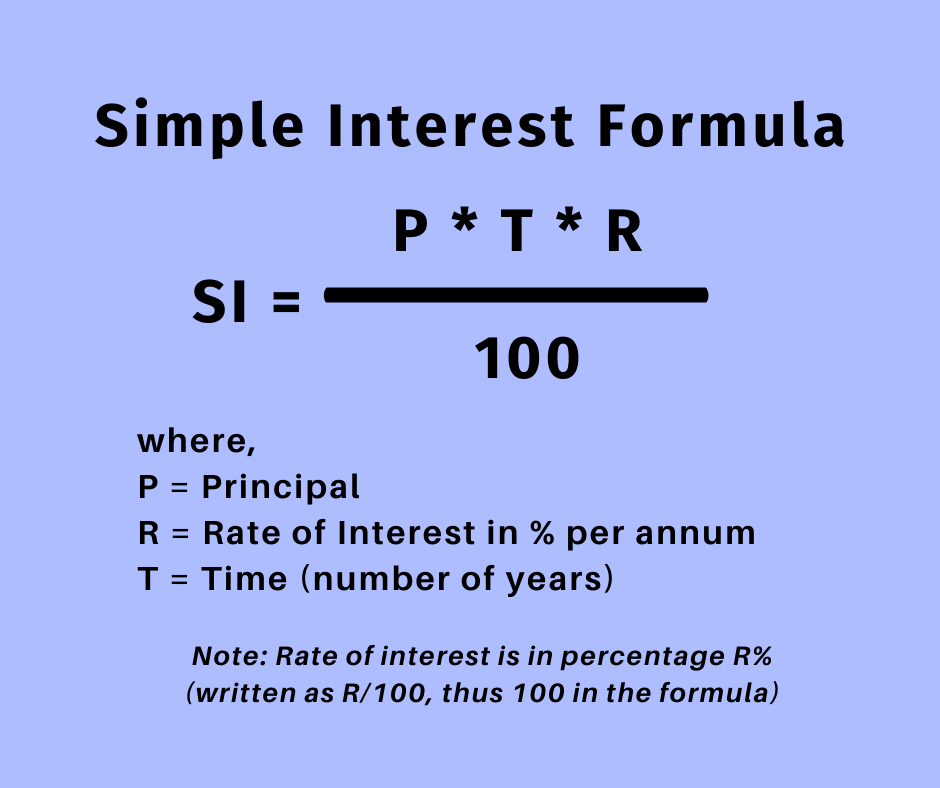

Simple Interest Calculation Formula

The formula for calculating simple interest is S.I. = (P * T * R)/100, where P stands for principal, R is for the annual percentage rate of simple interest, and T is for time, which is typically expressed as the number of years. The interest rate is expressed as R/100 and is written as R %.

So, Simple Interest (SI) = P * T * R

If ‘A’ represents the amount of total payment at the end of the total period, then

A = P + PTR = P (1 + TR)

Where, A = final amount, P = initial principal balance, R = annual simple interest rate, T = time (in years).

You can use the simple interest calculator above to understand how the relationship between the principal, interest rate, time period, and interest varies.

Simple Interest Calculation Example

Real-life example question for simple interest:

Question:

Tom borrowed $2000 from a friend to purchase a laptop. He promised to pay back the loan in 2 years with an annual interest rate of 6%. Calculate the total amount Tom needs to repay and the interest he will pay for the loan.

Solution:

Given data:

Principal amount (P) = $2000

Time period (n) = 2 years

Interest rate (R) = 6% (or 0.06 (as a decimal)

Step 1: Calculate Simple Interest (I):

Simple Interest (SI) = (Principal * Time * Rate) / 100

SI = (2000 * 2 * 6) / 100 = (24000) / 100

SI = $240

Step 2: Calculate Total Amount (A):

Total Amount (A) = Principal + Simple Interest = $2000 + $240

A = $2240

Answer:

Tom needs to repay a total amount of $2240, and the interest he will pay for the loan is $240.

Simple Interest vs. Compound Interest

Simple interest is calculated only on the principal amount of a deposit or loan. It does not take into account previous interest earned. The simple interest formula is:

Interest = Principal x Rate x Time/100

For example, if you deposit $1,000 at a simple interest rate of 5% for 2 years, the interest earned would be:

$1,000 x 0.05 x 2 = $100

Compound interest calculates interest on both the initial principal and the accumulated interest from previous periods. Interest earns additional interest, which results in faster growth compared to simple interest. The compound interest formula is:

Compound Interest = P(1 + r/n)^nt

Where: P = Initial principal balance r = Interest rate n = Number of compounding periods per year t = Total number of years

With annual compounding, $1,000 deposited at 5% interest for 2 years would earn:

$1,000 x (1 + 0.05/1)^(1 x 2) = $1,102.50

The additional $2.50 is interest earned on prior interest. Over long periods, compound interest grows money significantly faster than simple interest. This demonstrates the power of compounding and why it is more common for long-term deposits and loans.