SIP Calculator

How to use this SIP calculator?

Here are the step-by-step instructions on how to use this SIP calculator:

- Open the SIP calculator on your web browser.

- Enter the investment amount you wish to make in the “Investment Amount” field. This is the amount you plan to invest regularly through SIP.

- Enter the annual interest rate or expected rate of return you expect to earn on your investment in the “Expected Annual Interest Rate” field.

- Choose the frequency of your SIP investment, either monthly, quarterly, or yearly, from the “SIP Frequency” dropdown menu.

- Enter the investment duration or period in years in the “Investment Duration” field.

- Click on the “Calculate” button to see the estimated returns on your investment.

- Review the results. The SIP calculator will provide you with the future value of your investment, the total amount invested, and the interest earned during the investment period.

- If desired, adjust any of the input fields to see how it affects the estimated returns. You can experiment with different investment amounts, interest rates, SIP frequencies, and investment durations.

- Once you are satisfied with the results, you can decide whether to proceed with the investment or make any necessary adjustments based on your investment goals and risk appetite.

Remember that the results provided by the SIP calculator are estimates and may vary based on the actual performance of the investment vehicle. It is always a good idea to consult with a financial advisor or do your own research before making any investment decisions.

What is SIP (Systematic Investment Plan)?

A systematic Investment Plan (SIP) is a popular investment strategy in which an investor makes regular, periodic investments in a mutual fund or other investment vehicle. With SIP, the investor invests a fixed amount of money at regular intervals, typically monthly or quarterly, rather than making a one-time lump sum investment.

SIP allows investors to take advantage of the power of compounding, which can lead to significant long-term returns. By investing a fixed amount regularly, the investor can benefit from both the ups and downs of the market, buying more units of the investment when prices are low and fewer units when prices are high.

SIP is a flexible and convenient investment option that can be tailored to meet the needs and goals of individual investors. It is particularly well-suited for those who are new to investing or who want to invest in the stock market but may not have the expertise or resources to do so directly.

Formula to calculate SIP

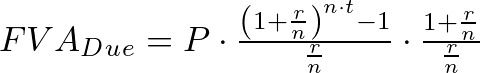

The total expected value in the future from SIP is calculated by the Future Value of the Annuity Due formula. The formula is as follows:

Where,

- FVA (Due): Future value (annuity due) of the investment

- P: Principal or initial investment amount

- r: Annual interest rate as a decimal

- n: Number of compounding periods per year (frequency)

- t: Number of years (investment period)

Conclusion

SIP calculators are useful tools that can help investors calculate their potential returns based on their investment amount, investment period, and expected rate of return. These calculators can provide investors with valuable insights into the potential outcomes of their investment decisions and help them make informed investment choices.