There is no doubt that Covid-19 has changed our ways of living in a way we would never imagine. While the risk of pandemic lifts up, several sectors that were wrecked up are trying their best to figure out the possible plans and upgrades, to lift the burden of the global pandemic. People are giving more importance to the basic needs of today- primarily food, home supplies, and medicine. Consumers all around the world are holding tight to their budget and avoiding the luxurious lifestyle or anything that can be left for later.

Started with Social Distancing, and the major health concerns that forced people to stay in their homes, and place visits have halted the impeccable crisis for the Real Estate industry. Due to the pandemic there had been declining in the sales chart of major sectors like transport, and travel, including housing as well.

Even though the market has not been completely spared by Covid-19, we can see few raises in the economic charts. Although reporters and analyzers predict that, the longer Covid-19 stays, it will be necessary to change the traditional behavior of how they operate actions. So it is likely that we will be able to see the different transformations and behavioral changes in different sectors if the crisis doesn’t end soon.

Current Challenges in US’s Real Estate Industry

Source: Realtor | Housing Market Index

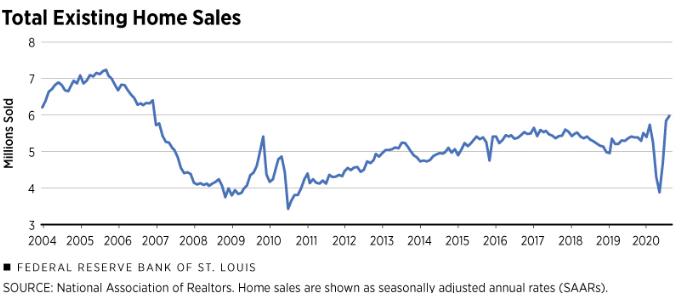

After the housing and financial crisis that led the Home Sales chart to the lowest ( above figure) from 2007 to 2009, the home sales count was still progressing before the pandemic.

According to the National Real estate Brokerage Redfin, the number of homes that were delisted increased up to 25% compared to the data in the same time frame- the previous year.

As the new home listing could not be added, the supply of new homes again dropped and set a new low.

Neither buyers nor sellers are comfortable buying and selling homes in the US. The recent data shows a decline of over 40% in house-buying activity since the buyers drastically decreased their search for new homes during the pandemic.

Unlike the Housing and Financial Crisis from 2007 to 2009 that resulted in price cuts, this time we can’t see that kind of effect in the price charts of Home Sales. As because of the Covid-19 pandemic, there were fewer names in the home show listings, and the mortgage rates were drastically dropped. These two effects impacted the market which led the price to remain steady as usual.

A Long-term based Behavioral Changes

Everywhere people are trying to figure out “What works?” to outlive the crisis and Real Estate owners and operators are planning the same. Each team is considering the long-term effect that the Coronavirus outbreak could hold. And changes made considering the crisis are likely to be seen soon.

Since the Covid-19 crisis has impacted everyone and rise in Job losses and abnormal economic lines, the housing sector will have to face a tough slap for some years. With all being adapted to crisis sections, the housing sector has also a few plans to consider.

Without a second thought, the housing industry is being affected by other platforms and will be affected by other industries in the near future as well. Although we can’t say what the Real Estate Industry has thought of in the future, we can predict its initial actions.

The era of digital life had already begun before the pandemic. Physical shops were turning to Online E-Commerce, live conferences were turning to video conferences, and people were searching digitally rather than going in the real world, for almost everything.

Some Real Estate owners who went with the vibe of technology had already prepared for the digital transformation in behavior. In case someone’s left to transform digitally- they need to do it quickly, before escaping the competition.

Buyers who would travel and look for spaces will mainly peek into their local market, the short-term leases can now be shifted to video conferencing, and physical shops will turn to e-commerce. With all this happening, it’s likely to predict that we can see more activity online rather than physical actions.

We can’t say how the Covid -19 has affected the economic aspects of the Real Estate industry. The real catastrophe that caused the human lives from the pandemic is still not seen. With that, we can say there will significant behavioral changes which will lead to significant space becoming obsolete in the current situation. Real Estate and investors have still a chance to shift their business to the next paradigm and can do well if they take immediate actions while considering the potential future.

A new possible transformation for Real Estate Industry could be Centralizing Cash Management. Currently, the Real Estate market is highly dominated by decentralized cash management. In fact, most of the cash transactions or settlements are done at ground level. However, under the current circumstances, we can see a slight shift of the cash flow to the top level. Now top-level management can provide a cash flow through a centralized channel. This can help the people at both the company level and property level to find the specific efficiency analyzed from the properties and business as a whole.