As a real estate agent, staying informed about the various tax-advantaged accounts available to you is essential. These accounts can help you save money on taxes and can also be used to save for retirement or other financial goals. In this article, we will discuss seven tax-advantaged accounts that every real estate agent should consider.

1. Traditional IRA

A traditional IRA is a type of individual retirement account that allows you to save for retirement on a tax-deferred basis. Contributions to a traditional IRA are typically tax-deductible, and the money in the account grows tax-free until you withdraw it in retirement.

2. Roth IRA

A Roth IRA is similar to a traditional IRA, but contributions are made on a post-tax basis. This means that you do not get a tax deduction for your contributions, but the money in the account grows tax-free and withdrawals in retirement are also tax-free.

3. SEP IRA

A SEP IRA (Simplified Employee Pension IRA) is a retirement plan for self-employed individuals, including real estate agents. Contributions to a SEP IRA are tax-deductible, and the money in the account grows tax-free until you withdraw it in retirement.

4. Solo 401(k)

A solo 401(k) is a retirement plan for self-employed individuals with no employees. Contributions to a solo 401(k) are tax-deductible, and the money in the account grows tax-free until you withdraw it in retirement.

5. Health Savings Account (HSA)

An HSA is a tax-advantaged medical savings account that can be used to pay for qualified medical expenses. Contributions to an HSA are tax-deductible, and the money in the account grows tax-free. Withdrawals for qualified medical expenses are also tax-free.

6. Flexible Spending Account (FSA)

An FSA is a tax-advantaged account that can be used to pay for qualified medical and dependent care expenses. Contributions to an FSA are made on a pre-tax basis, which means that you do not pay taxes on the money you put into the account. Withdrawals for qualified expenses are also tax-free.

7. 529 College Savings Plan

A 529 plan is a tax-advantaged savings plan for education expenses. Contributions to a 529 plan are typically not tax-deductible, but the money in the account grows tax-free and withdrawals for qualified education expenses are also tax-free.

It’s important to consult with a tax professional or financial advisor to determine which tax-advantaged accounts are right for you and how to set them up and manage them properly.

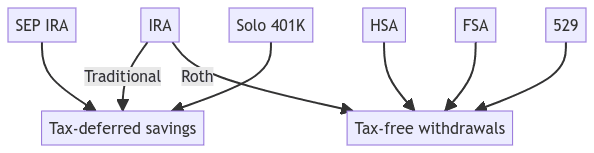

Summary Diagram

The following diagram summarizes the above information.

This diagram shows different types of individual retirement accounts (IRA) and other savings plans, and how they relate to taxes. The Traditional IRA and Simplified Employee Pension (SEP) plans offer tax-deferred savings, meaning taxes are not paid on the contributions or investment gains until they are withdrawn. The Roth IRA, Solo 401(k), and Health Savings Account (HSA) offer tax-free withdrawals, meaning taxes have already been paid on the contributions, and withdrawals are not subject to additional taxes. The Flexible Spending Account (FSA) also offers tax-free withdrawals, but it is not an account for retirement savings, instead, it is an account for medical expenses. The 529 plan is a savings plan for education expenses, and withdrawals are tax-free if used for qualified education expenses.

Conclusion

As a real estate agent, it is important to take advantage of the various tax-advantaged accounts available to you. These accounts can help you save money on taxes, and can also be used to save for retirement or other financial goals. Whether you are just starting out in the industry or have been working as a real estate agent for many years, it is essential that you stay informed about the different types of accounts available and how to use them to your advantage. With the right planning and management, you can build a strong financial foundation that will support you throughout your career and into retirement.