When it comes to financing your goals or needs, credit can be a useful tool. However, not all credit is created equal. There are two main types of credit – installment credit and revolving credit – each with its unique features and benefits. In this article, we’ll explore the differences between these two types of credit and help you decide which one is right for you.

What is Installment Credit?

Installment credit is a type of credit that involves borrowing a fixed amount of money, which is then paid back over a set period, with interest. The most common examples of installment credit include mortgages, car loans, and personal loans.

When you take out an installment loan, you’ll typically receive the entire loan amount upfront, and then make regular payments (usually monthly) until the loan is fully paid off. Each payment you make goes towards paying off both the principal amount of the loan and the interest charges.

The main advantage of installment credit is that it provides predictable payments over a set period, which can make it easier to budget and plan for. Additionally, installment loans typically come with lower interest rates than other forms of credit, making them a cost-effective option for borrowing large sums of money.

What is Revolving Credit?

Revolving credit, on the other hand, is a type of credit that allows you to borrow up to a certain amount of money, known as your credit limit. You can then use and repay this credit as often as you like, as long as you stay within your credit limit. The most common examples of revolving credit include credit cards and lines of credit.

With revolving credit, you’ll typically make minimum payments each month, which will go towards paying off the interest charges and a portion of the principal balance. You can choose to pay more than the minimum payment if you wish, which will help you pay off your balance more quickly and reduce your overall interest charges.

The main advantage of revolving credit is that it provides flexibility and convenience, allowing you to borrow and repay as needed, without having to apply for a new loan each time. Additionally, revolving credit often comes with rewards programs, such as cashback or airline miles, which can provide added benefits for responsible users.

Key Differences between Installment and Revolving Credit

While both installment credit and revolving credit allow you to borrow money, there are several key differences between the two:

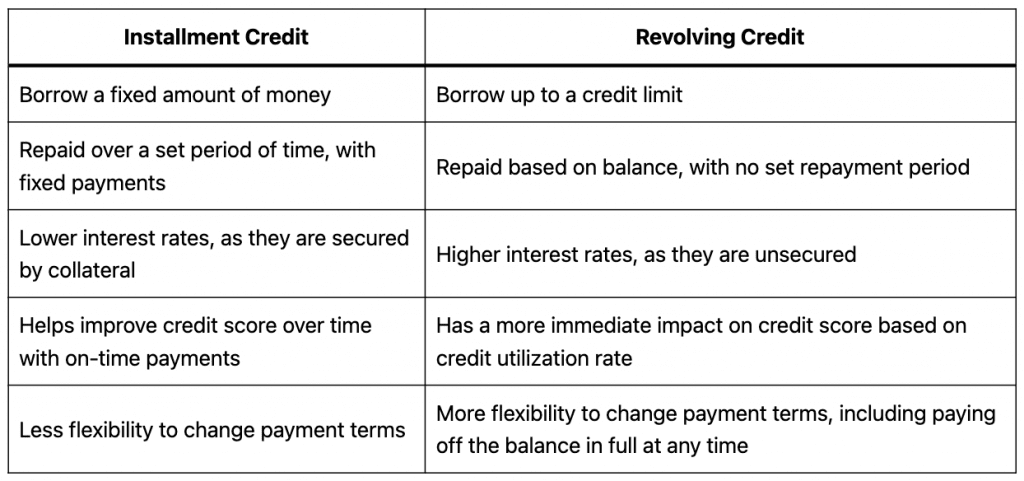

here is a table summarizing the main differences between installment and revolving credit:

1. Payment Terms

With installment credit, you’ll make fixed payments over a set period of time, until the loan is fully paid off. With revolving credit, you’ll make payments based on your balance, with no set repayment period.

2. Interest Rates

Installment loans typically come with lower interest rates than revolving credit, as they are secured by collateral (such as a house or car). Revolving credit, on the other hand, tends to have higher interest rates, as it is unsecured.

3. Credit Scores

Your credit score will be affected differently depending on the type of credit you use. Installment loans can help improve your credit score over time, as long as you make your payments on time. Revolving credit, however, can have a more immediate impact on your credit score, as it is based on your current credit utilization rate (the amount of credit you’re using compared to your credit limit).

4. Repayment Flexibility

With installment loans, you’ll have less flexibility to change your payment terms once you’ve signed the loan agreement. With revolving credit, you can choose to pay more or less than the minimum payment each month, and can even pay off your balance in full at any time.

Installment and revolving credit, which type of credit is right for you?

Ultimately, the type of credit that is right for you will depend on your personal financial situation and borrowing needs.

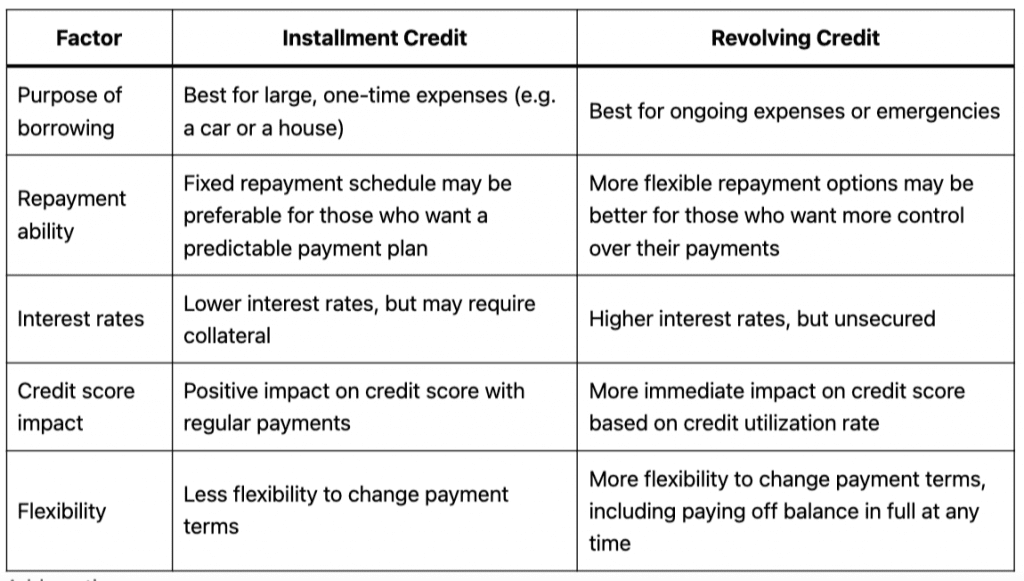

Here are some factors to consider when deciding between installment and revolving credit:

1. Purpose of borrowing:

If you need to borrow a large sum of money for a specific purpose (such as buying a house or car), then installment credit may be the best option. On the other hand, if you need to borrow money for ongoing expenses or for emergencies, then revolving credit may be more appropriate.

2. Repayment ability

Consider your ability to make regular payments. If you prefer a predictable repayment schedule, then installment credit may be the way to go. However, if you need more flexibility in your payments, then revolving credit can provide that.

3. Interest rates

Interest rates can vary widely depending on the type of credit and lender. If you have a good credit score and can secure a low-interest rate, then installment credit may be the more cost-effective option. However, if you can’t get a low-interest rate, then revolving credit may be the better choice.

4. Credit score impact

If you’re trying to improve your credit score, then installment credit may be more beneficial, as it demonstrates your ability to make regular payments over time. Revolving credit can also help improve your credit score, but it can also hurt your score if you have high balances or miss payments.

Summary

In summary, both installment and revolving credit have their advantages and disadvantages. It’s important to understand the differences between the two and to choose the type of credit that best suits your needs and financial situation. Remember to always borrow responsibly and to make payments on time, as this will help you build a strong credit history and improve your financial well-being in the long run.