In the world of business and personal finance, it is crucial to understand the various options available when acquiring assets. Two common methods often employed for acquiring equipment, vehicles, or other assets are hire purchase and leasing. While both options allow individuals and organizations to gain access to necessary resources without large upfront costs, they differ significantly in terms of ownership, flexibility, and financial implications. In this article, we will delve into the intricacies of hire purchase and leasing, examining their key differences, benefits, and potential drawbacks to help you make informed financial decisions.

Defining Hire Purchase

Hire purchase, also known as an installment plan, refers to a financial arrangement wherein an individual or organization hires an asset from a vendor with the intention of eventually owning it. Under a hire purchase agreement, the purchaser pays an initial deposit followed by regular installments over a predetermined period. The asset remains the property of the vendor until the final payment is made, at which point ownership is transferred to the purchaser.

Example of Hire Purchase

Suppose a small business requires a delivery van to expand its operations. Instead of purchasing the van outright, the business opts for a hire purchase. They pay a 20% deposit and agree to monthly installments over a period of five years. Once the final installment is paid, ownership of the van is transferred to the business.

Understanding Leasing

Leasing, on the other hand, involves an individual or organization renting an asset from a lessor for a specified period. Unlike hire purchase, leasing does not involve ownership transfer. Instead, the lessee gains access to the asset for the duration of the lease term, paying regular lease payments as agreed upon in the contract. At the end of the lease term, the lessee typically has the option to return the asset, extend the lease, or purchase the asset at a predetermined residual value.

Example of Leasing

A technology company requires specialized equipment for a short-term project. Instead of investing a substantial amount in purchasing the equipment, they opt for leasing. The company enters into a lease agreement for six months, paying monthly lease payments during this period. At the end of the lease term, they return the equipment to the lessor.

Difference between Hire Purchase and Leasing

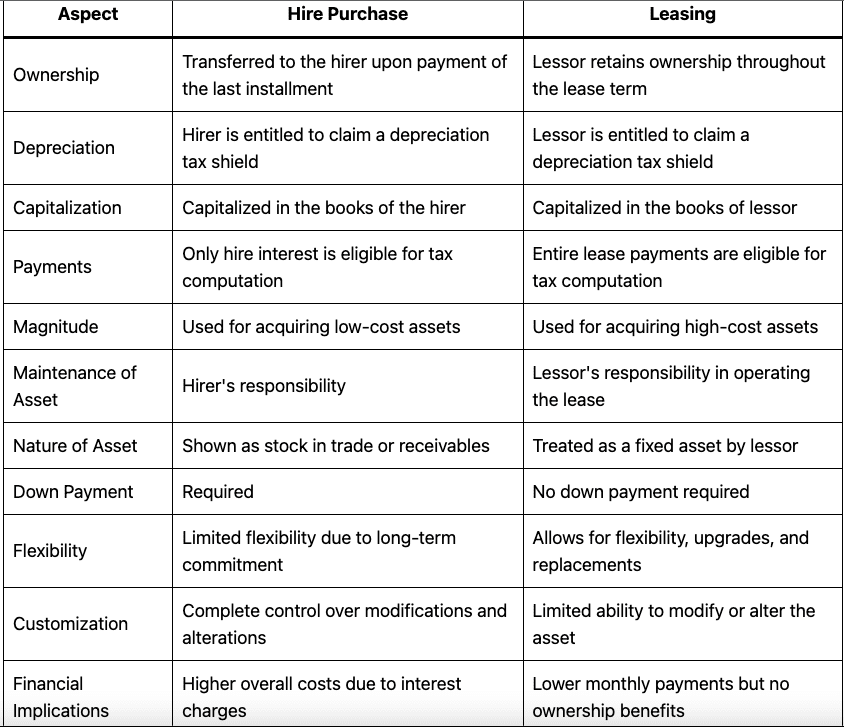

1. Ownership Considerations

One of the key distinctions between hire purchase and leasing lies in the ownership of the asset. In a hire purchase, ownership is transferred to the purchaser upon completing all payments. This provides the advantage of long-term ownership and the ability to sell or modify the asset as desired. In contrast, leasing does not confer ownership rights. The lessee essentially rents the asset for a predetermined period, limiting their ability to make alterations or sell the asset without the lessor’s consent.

2. Depreciation

In leasing, the lessor is entitled to claim the depreciation tax shield since they retain ownership of the asset. On the other hand, in a hire purchase, the hirer is entitled to claim the depreciation tax shield as they eventually become the owner of the asset.

3. Capitalization

Capitalization refers to the accounting treatment of an asset. In leasing, the asset is capitalized in the books of the lessor since they retain ownership. In hire purchase, the asset is capitalized in the books of the hirer since ownership is transferred to them upon completion of payments.

4. Payments

In leasing, the entire lease payments made by the lessee are eligible for tax computation in their books. However, in hire purchase, only the hire interest portion is eligible for tax computation in the books of the hirer.

5. Magnitude

Leasing is commonly used as a source of finance for acquiring high-cost assets such as machinery, ships, and other expensive equipment. On the other hand, hire purchase is often used for acquiring low-cost assets such as automobiles, office equipment, and other relatively affordable items.

6. Maintenance of Asset

In leasing, the responsibility for asset maintenance lies with the lessor in the case of an operating lease. However, in the case of a financial lease, the lessee is responsible for the maintenance of the asset. In hire purchase, it is the hirer’s responsibility to ensure the maintenance of the asset they have purchased.

7. Nature of Asset

Under a leasing agreement, the asset is treated as a fixed asset in the books of the lessor. On the other hand, in a hire purchase, the asset is shown either as a stock in trade or as receivables in the books of the hirer.

8. Down Payment

In leasing, no down payment is required upfront. The lessee can make regular lease payments without an initial deposit. In a hire purchase, a down payment is usually required, which serves as an initial contribution towards the asset purchase.

9. Flexibility and Customization

When it comes to flexibility and customization, leasing offers certain advantages over hire purchases. Since leasing contracts are typically shorter term, lessees have the option to upgrade to newer models or equipment once the lease expires. This flexibility allows businesses to adapt to evolving technological advancements or changing market demands more easily. In contrast, hire purchase involves a more long-term commitment, limiting the ability to replace or upgrade assets without incurring additional costs.

10. Financial Implications

Financial implications play a significant role in deciding between hire purchase and leasing. Hire purchases usually requires an upfront deposit, followed by regular installment payments, which include interest charges. This results in higher overall costs compared to the cash price of the asset. However, as the payments are spread over time, it allows for better cash flow management and enables businesses to acquire assets that might otherwise be unaffordable upfront.

Leasing, on the other hand, often involves lower monthly payments compared to hire purchase, as the lessee is essentially renting the asset. However, it is important to consider the total cost of the lease over its duration, including any additional fees or charges. Furthermore, since the lessee does not own the asset, they do not benefit from its appreciation and may have limited tax benefits compared to a hire purchase arrangement.

Conclusion

In conclusion, hire purchase and leasing are two distinct financial arrangements used to acquire assets without substantial upfront costs. While hire purchase allows for eventual ownership and long-term commitment, leasing provides flexibility, customization, and lower monthly payments. When deciding between the two, it is essential to consider factors such as ownership considerations, depreciation, capitalization, payments, magnitude, maintenance of assets, nature of assets, down payment requirements, flexibility needs, and financial implications. By understanding the differences between hire purchase and leasing, individuals and organizations can make well-informed decisions that align with their specific requirements and financial goals. Remember, the choice between hire purchase and leasing depends on various factors, and it is advisable to seek professional advice to ensure the best decision for your unique circumstances.