Adaptive expectations is an economic theory that gives importance to past events in predicting future outcomes. It assumes that people’s expectations about the future value of an economic variable are based on past values. The theory proposes that people form expectations about inflation, unemployment, interest rates, etc. by looking at past trends and experiences.

Initially introduced by Irving Fisher and gaining prominence during the 1950s, this principle offers a unique perspective on how individuals anticipate and react to economic changes based on historical data.

Understanding the Adaptive Expectations Principle

At its core, the Adaptive Expectations Principle, often known as the error learning hypothesis, asserts that individuals form predictions about future economic variables by drawing from their past values and associated errors. In other words, if you want to anticipate how inflation or interest rates will change in the coming years, look no further than their historical performance. This notion gained traction during the study of hyperinflation during the 1950s, offering insights into how people responded to extreme economic volatility.

A simple formula for adaptive expectations is:

Pe = Pt-1

Where

Pe = Expected value in the current period

Pt-1 = Actual value in the previous period

This means people expect inflation or any other economic variable in the current period to be the same as it was in the previous period. As new data becomes available, people revise their expectations accordingly.

For instance, consider the case of predicting inflation. According to adaptive expectations, if inflation rates surged in the past year, individuals would anticipate a higher inflation rate in the following year.

Applying Adaptive Expectations

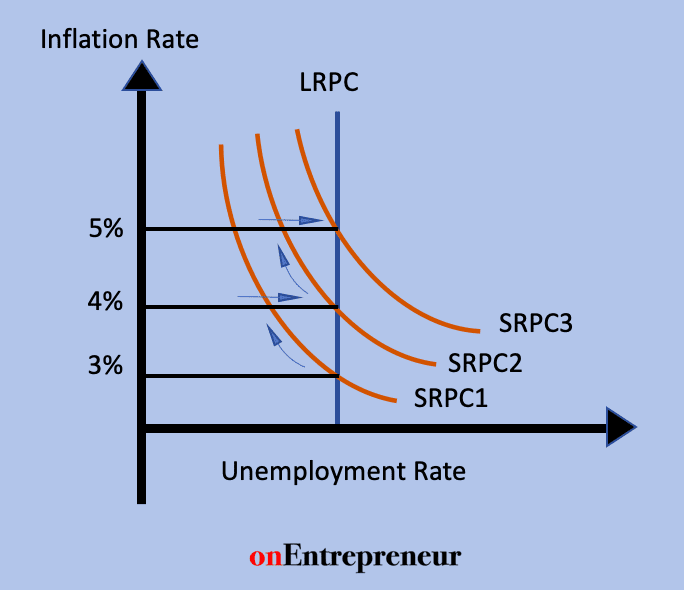

The Adaptive Expectations Principle finds a home in various economic scenarios, one of which is exemplified by the Monetarist view of the Phillips curve.

For example, if inflation was 2% last year, the model states that people will expect inflation to be 2% in the current year as well. However, if actual inflation turns out to be 3%, people will adapt and expect inflation of 3% next year. Consequently, the trade-off between inflation and unemployment worsens, indicating a change in the short-run Phillips Curve.

This adaptability extends further. If demand escalates again, initial inflation expectations will rise to 4%. Yet, as reality reveals a more substantial inflation rate of 5%, expectations are promptly revised upward. This adapt-and-learn process intricately weaves the past and present, guiding future economic predictions.

Limitations of Adaptive Expectations Principle

Limitations

Adaptive expectations have been criticized for being too simplistic. The theory assumes people mechanically look at past data rather than incorporating a wide range of information. It doesn’t account for changing trends or shocks.

The adaptive expectations approach underestimates or overestimates the changing behavior of variables, and focuses only on past performance. In the early 1970s, it was deemed unreliable and thus abandoned.

The theory has largely been replaced by rational expectations, which assume that people make use of all relevant information rather than just past experiences. However, the adaptive expectations principle remains influential in modeling price and wage dynamics.

Rational Expectations: A Forward-Looking Alternative

The rational expectations theory presents a paradigm shift from the Adaptive Expectations Principle. It posits that individuals are forward-looking and possess a heightened ability to anticipate future economic changes accurately. This theory suggests that people don’t merely react to events; they anticipate them. For instance, if the government were to propose an inflationary tax cut or interest rate reduction, individuals operating under rational expectations would foresee the impending inflation and adjust their behaviors accordingly.

However, rational expectations come with their own set of challenges. This theory assumes that the average consumer possesses a remarkable level of economic insight and knowledge, which might not always align with reality. Human behavior, after all, is a blend of rational and emotional responses.

Conclusion

The adaptive expectations model proposes that people’s predictions about future economic values are anchored in past experiences and adjust gradually over time. Despite limitations, it provides important insight into how expectations are formed and their role in macroeconomic dynamics. The theory continues to serve as a foundation for more sophisticated expectation formation models.