The direct method of cost allocation is a technique used by businesses to assign costs directly to specific cost objects or activities. The direct method of cost allocation is a technique used by businesses to assign costs directly to specific cost objects or activities. Unlike step down method, It is a straightforward approach that does not involve allocating costs to intermediate cost pools before assigning them to cost objects.

It involves identifying a cause-and-effect relationship between the cost object and the cost driver. This method provides simplicity and transparency in cost assignment, although it may not consider indirect costs associated with other activities or departments.

Example of Direct Method of Cost Allocation

Example:

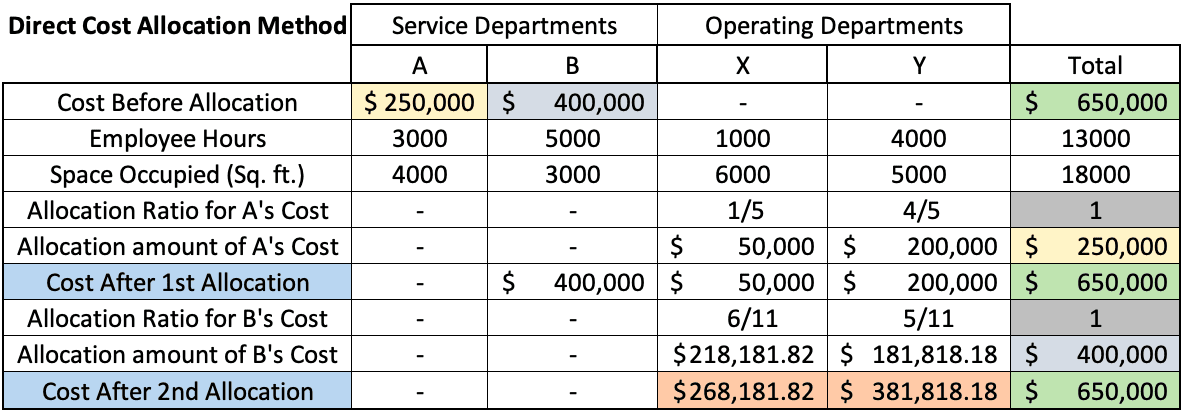

The XY Company uses the direct method for allocating the costs of its service departments to operating departments. The company has two service departments and two operating departments.

Required: Allocate the cost of service departments (A, B) to operating departments (X, Y) using the direct method.

Solution:

Allocation of Department A’s cost:

Allocation ratio:

- Department X: Employee Hours in Department X / Total Employee Hours (Except A and B)

- Department Y: Employee Hours in Department Y / Total Employee Hours (Except A and B)

The allocation ratios are as follows:

Department X: 1/5, Department Y: 4/5

1st Allocation

- Allocated to Department X: $250,000 × (1/5) = $50,000

- Allocated to Department Y: $250,000 × (4/5) = $200,000

Allocation of Department B’s cost:

Allocation ratio:

- Department X: Space Occupied by Department X / Total Space Occupied (Except A and B)

- Department Y: Space Occupied by Department Y / Total Space Occupied (Except A and B)

The allocation ratios are as follows:

Department X: 6/11, Department Y: 5/11

2nd Allocation

- Allocated to Department X: $400,000 × (6/11) = $218,181.82

- Allocated to Department Y: $400,000 × (5/11) = $181,818.18

Important things to remember in Direct Method

- First step: Service departments A and B’s costs are not allocated to departments A and B but to operating departments X and Y. The allocation base of departments A and B is ignored.

- The allocation base of a service department is always ignored in both step-down and direct methods of cost allocation when allocating costs to other departments.

- Second step: Department B’s total cost ($400,000) is allocated to departments X and Y. No portion of Department B’s cost is allocated to Department A.

- The total costs before and after each allocation are equal. It is because no money is lost during the process.

- The sum of allocation ratios is unity. (No allocation outside the defined scope)

- In the above figure, you can see the matching color cells to check whether the calculations are right or not.

Advantages of the Direct Method of Cost Allocation

a) Simplicity:

The direct method of cost allocation is relatively simple to understand and implement. It involves directly assigning costs to specific cost objects based on a cause-and-effect relationship with the cost driver. This straightforward approach makes it easier for managers and employees to grasp and apply.

b) Transparency:

The direct method provides transparency in cost allocation. The direct allocation of costs clearly identifies which specific objects are incurring the costs. This transparency can help in decision-making, as it allows for a better understanding of the cost structure and facilitates the identification of cost-saving opportunities.

c) Accuracy for Direct Costs:

The direct method of cost allocation is particularly effective when allocating direct costs that have a clear cause-and-effect relationship with the cost objects. This method accurately assigns direct costs, such as materials and labor, as their relationship with the cost driver is typically more direct and easily measurable.

d) Efficiency:

The direct method is generally more efficient compared to other complex cost allocation methods. Since it skips the step of allocating costs to intermediate cost pools, it saves time and resources. This efficiency is beneficial for businesses that need a quick and practical approach to allocating costs.

e) Useful for Simple Cost Structures:

The direct method works well when the cost structure is relatively simple and there are no significant indirect costs to consider. The direct method offers a suitable and efficient allocation solution in situations where it is possible to directly trace the majority of costs to specific cost objects.

Conclusion:

The direct method of cost allocation provides a straightforward approach for assigning costs to cost objects based on the cause-and-effect relationship between the cost driver and the cost object. However, it’s important to note that the direct method may not account for indirect costs associated with other activities or departments. Businesses should carefully consider the suitability of this method based on their specific cost allocation needs and circumstances.