In finance, risk and return are highly related terms. They are most important topics that they form the foundation of modern finance. Every investment decision involves risk and return measurement and trade off.

Risk is the probability of getting returns that are usually not expected and in some cases not getting returns at all. By saying not expected returns, we can assume returns that are either more than expectations or less than the expectations.

While return refers to the results that come from certain investments and trades. Returns can either be gain or be loss and are specifically calculated in terms of percentage.

Suppose, my friend Mr. X brings me an interesting offer. He asked me to invest in a stock XYZ that would either give 15% returns or 100% loss of my capital. Now assume that, if you have invested in the stock there’s only a 1% chance of losing everything. However, the chances of getting a 15% return are 99%.

Therefore, in this situation, I have a 1% risk of losing all my capital invested in that stock.

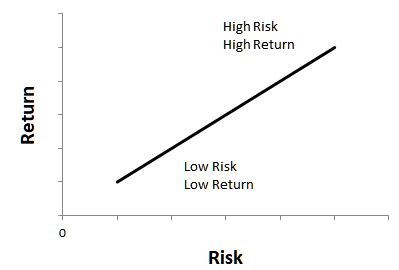

Usually, we see risk and return having a negative relation. If there is a high risk, that is likely to have high returns and vice versa.

To do a comparative analysis of risk and returns, we use a popular model called Capital Asset Pricing Model. The CAPM model clears the relationship between expected return and risk of that investment or security.